florida inheritance tax amount

For 2016 the gift and estate tax lifetime exemption amount is set to be 545 million. Additionally counties are able to levy local taxes on top of the state amount and most do55 of the 67 Florida counties added local sales tax to the state tax in 2012.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

My wifes father is going to be giving us a substantial amount of money to buy a house in the 150k area.

. 3 Oversee property tax. A charitable religious educational or other organization as defined in sections 170c and 2055 of the IRC. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax.

Proper estate planning can lower the value of an estate such that no or minimal taxes are owed. There isnt a limit on the amount you can receive either any money you receive as an inheritance is tax-free at the. That limit is tied to the gift tax exemption and is now indexed to inflation.

Tax rates start at 306 on amounts up to 500000 and gradually increase to the highest rate of 16 on amounts over 10100000. Its against the Florida constitution to assess taxes on inheritance no matter how much its worth. Citizen the Florida estate tax exemption amount is still 114 million.

We will be mortgaging the remaining amount for the house. This means that if you die in Florida and your estate is less than the federal exemption amount your heirs do not need to worry about estate inheritance or death taxes. This applies to the estates of any decedents who have passed away after December 31 2004.

Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an. 5 of the share. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

The Federal government imposes an estate tax which begins at a whopping 40this would wipe out much of the inheritance. That will increase to 8 counties in 2013. Posted by 8 years ago.

This means if your mom leaves you 400000 you get 400000 there are no taxes to pay. Even if youre a US. 9 The tax rate ranges from 11 to 16 depending on the size of inheritance and relationship.

What that means is that estates valued at less than that amount wont be subject to the federal tax. If an individuals death occurred prior to that time then an estate tax return would need to be filed. Heirs whose identity or place of residency cannot be ascertained with reasonable certainty.

Florida Inheritancegift tax question. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax. The highest amount added to the sales tax was 15 by 7 counties in 2012 bringing the total sales tax to 75 in those counties.

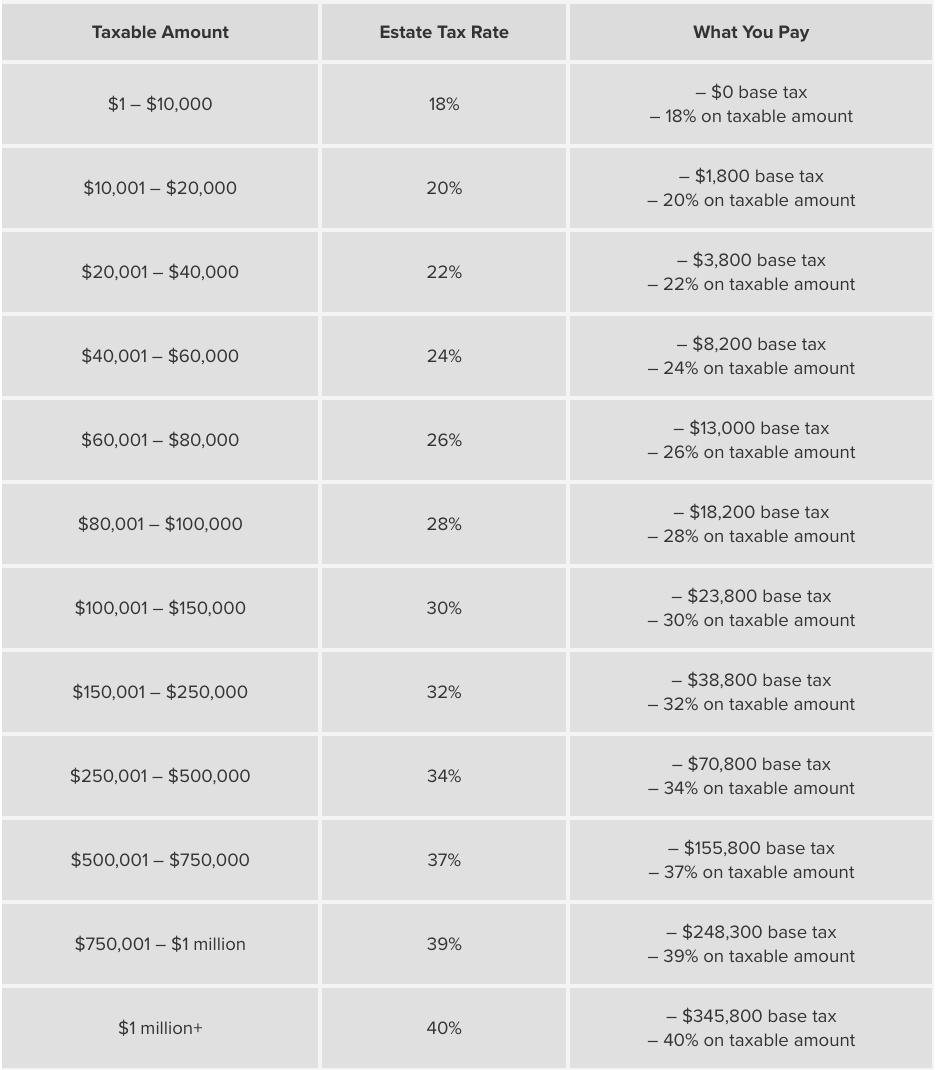

The full tax table is available on the New York State Estate Tax. Inheritance tax doesnt exist in Florida at any level. The federal government however imposes an estate tax that applies to residents of all states.

Nor does it have an inheritance tax. There are no inheritance taxes or estate taxes under Florida law. No inheritance or estate tax in Florida.

Florida Inheritancegift tax question. In 2021 federal estate tax generally applies to assets over 117 million. You also pay 34 on the remaining 70000 which comes to 23800.

For an inherited home you wont meet the requirements for the 250000 capital gains exclusion unless you live in the property for two years after inheriting. Spouse and minor children. However a spouse grandparent child or grandchild will owe no inheritance tax regardless of the amount.

The Florida estate tax was repealed effective Dec. The states constitution prohibits it. Other Ways to Avoid Taxes.

All other shares to income tax exempt organizations must. If your estate is worth less than this youll need to pay the federal income tax as well as any possible federal income taxes. For example someone residing in New Jersey who receives an inheritance from a sibling will owe tax on any inheritance that exceeds 25000.

For a married couple that means they can exempt a total of 109 million between them. There is no federal inheritance tax but there is a federal estate tax. Estate and Inheritance Taxes There are no death taxes otherwise known as inheritance taxes in Florida on the value of estates or inheritances.

31 2004 and it cannot be reinstated. Your base payment is 70800 on the first 250000. Florida does not have a separate inheritance death tax.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. There is no inheritance tax or estate tax in Florida. However since the property value is stepped-up to current fair market value this minimizes your potential tax liability and proceeds over.

The federal estate tax only applies if the value of the estate exceeds 114 million 2019 and the tax thats incurred is paid out of the estatetrust rather than by the beneficiaries. As previously mentioned Florida does not have an estate tax. Other popular options used to help reduce your estates exposure to inheritance taxes include but are not limited to the following.

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Florida does not have an inheritance tax but a few states do including. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit 11700000 in 2021.

Thats right there is no estate tax for the vast majority of US citizens. Is there going to be some form of gift or inheritance gift. Subtracting the exemption of 1118 million creates a taxable estate of 320000.

As of January 1 2017 the federal estate tax applies to all estates worth more than 549 million. If you have 5 million or less congratulations. Inheritance and Property Acquisitions.

That plus the base of 70800 means your total estate tax burden is. Siblings and sondaughter-in-laws exempt up to 25000.

2021 Estate Income Tax Calculator Rates

Florida Estate Tax Rules On Estate Inheritance Taxes

The Death Tax Talk Is Back Tax Politics By Lindsey Cormack 3streams Medium

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Restoring The Federal Estate Tax Is A Proven Way To Raise Revenue And Address Wealth Inequality Equitable Growth

Limit Your Minnesota Estate Taxes Via Estate Planning Lawyer Wayzata Legal

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Recent Changes To Estate Tax Law What S New For 2019

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Attorney For Federal Estate Taxes Karp Law Firm

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Restoring The Federal Estate Tax Is A Proven Way To Raise Revenue And Address Wealth Inequality Equitable Growth

Florida Inheritance Tax Beginner S Guide Alper Law

What Happened To The Expected Year End Estate Tax Changes

How Do State Estate And Inheritance Taxes Work Tax Policy Center